does texas have inheritance tax 2021

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Estate Tax Protection Planning Norris Golubovic Pllc

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

. Inheritance laws in Texas are generally less complicated than in other states since Texas does not impose any inheritance or estate tax. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Nov 2 2021 Wills And Probate.

That increase is set to end in 2025 but both the Treasury Department and. As noted only the wealthiest estates are subject to this tax. Some states also have estate taxes see the list of states here and.

In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from 567 million in 2020 to 4 million for. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. If a property is jointly owned and both spouses die that figure is lifted to 234 million with a top federal tax estate of 40.

State Inheritance tax rate. A strong estate plan starts with life insurance. Texas inheritance laws to keep in mind.

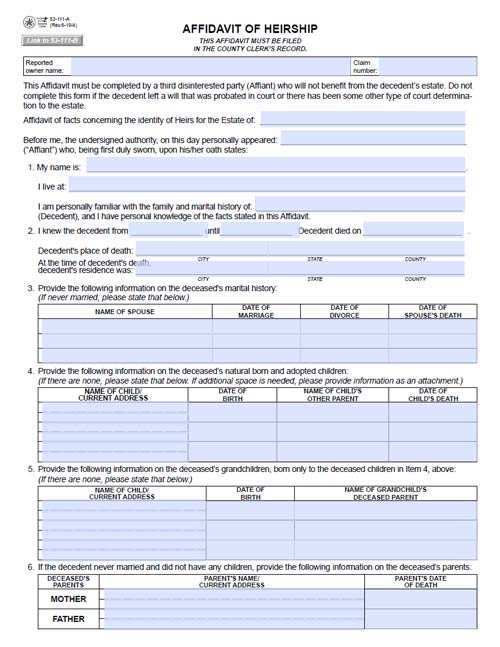

Texas law requires an inventory of all estate assets. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. As of 2021 only six states impose an inheritance tax and.

The rate increases to 075 for other non-exempt. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117 million. Estates with a will that are valued at less than 75000 do not have to go through the.

Does Texas Have an Inheritance Tax or Estate Tax. Estate tax applies at the federal level but very few people actually have to pay it. For 2021 the IRS estate tax exemption is 117 million per individual which means that a person could leave 117 million to her heirs and pay no federal estate tax while a married couple could collectively shield234 million.

Heres why it starts so late. State inheritance tax rates in 2021 2022. The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. On Behalf of Michalk Beatty Alcozer LP. Inheritance taxes in Texas.

Probate Laws in Texas. But there is a federal gift tax that people in Texas have to pay. Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal.

How much can you inherit without paying taxes in Texas. For 2020 and 2021 the top estate-tax rate is 40. There is a 40 percent federal tax however on estates over 534 million in value.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. Gift Taxes In Texas. This includes personal property real estate cash retirement accounts investments and life insurance policies.

Most people dont have to. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Texas repealed its inheritance tax law in 2015 but other tricky rules can apply depending on what you do with the money or property.

In 2020 the exemption was 1158 million per individual 2316 million per married couple. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. For 2021 the IRS estate tax exemption is 117 million per individual which means that a.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The estate is everything the person owned at the time of death.

However in Texas there is no such thing as an inheritance tax or a gift tax. There is a. MoreIRS tax season 2021 officially kicks off Feb.

Probate is the process of recognizing a persons death and closing up their estate. New York raised its exemption level to 525 million this year and will match the federal exemption level by 2019. Married couples can shield up to 2412 million together tax-free.

Moreover the tax is paid by the beneficiary after the assets have been transferred out of the estate. Does Texas Have an Inheritance Tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of TexasThere is a 40 percent federal tax however on estates over 534 million in value.

Beth would be responsible for paying the tax. An inflation adjustment increased this amount to 117 million per person and 234 million per couple. Gift Tax Exemptions.

Note that historical rates and tax laws may differ. Anything over these amounts will be taxed at a rate of 40. You can give a gift of up to 15000 to a.

Understanding how Texas estate tax laws apply to your particular situation is critical. Your 2020 tax returns. These states have an inheritance tax.

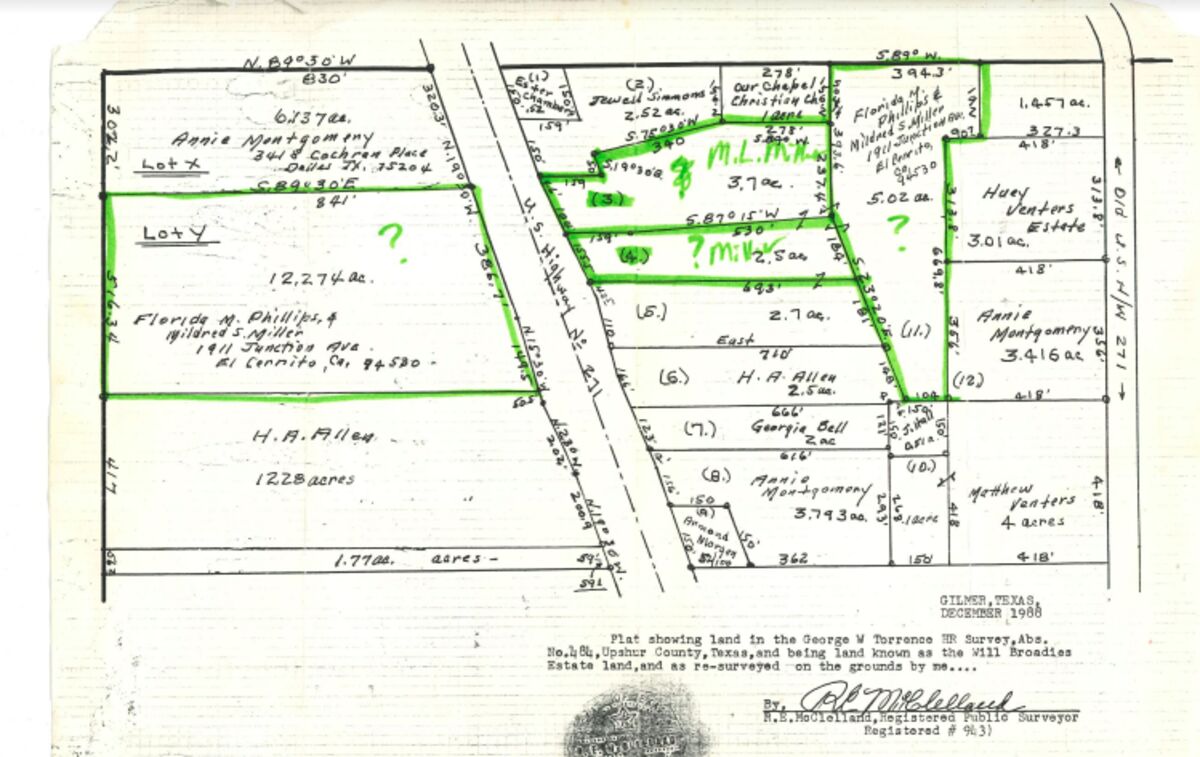

Pay Check Podcast Season 3 My Family S Land Shows How Black Wealth Is Won Lost Bloomberg

Pay Check Podcast Season 3 My Family S Land Shows How Black Wealth Is Won Lost Bloomberg

Conroe Tx Probate Attorney Linzer And Gaines

Estate Tax Planning Petrosewicz Law Firm P C Richmond Texas

Yahoo Finance Estate Tax Rates Limits Exemptions And Other Rules You Need To Know Time Sensitive Executorium

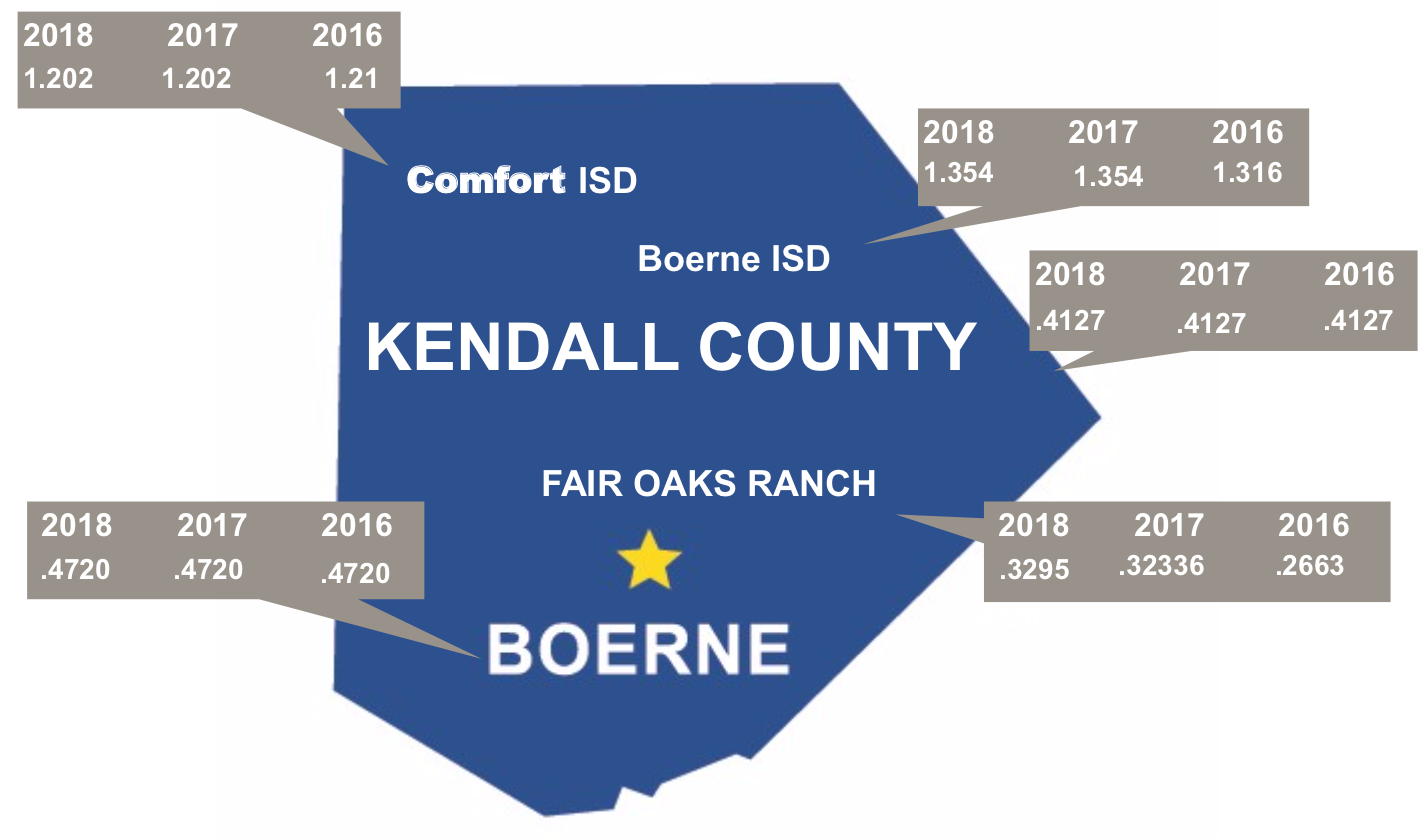

Tax Advantages Boerne Kendall County Economic Development Corporation

Estate Planning 2022 Federal Tax Update Lathrop Gpm Jdsupra

Tax Implications Of Selling Commercial Real Estate 2022 Guide Property Cashin

New Episode Of The Estate Of The Union Podcast Texas Trust Law

.png)

Texas Medicaid Estate Recovery Program Merp

Inheritance Tax Proposals Target Family Farms Ranches Texas Farm Bureau

How To Sell A Probate House In Texas In 2021 The Ultimate Guide

Estate Planning Archives Stonemyers Law Estate Business Planning

A Guide To Estate Taxes Mass Gov

Probate Fees In Texas Updated 2021 Trust Will

How To Sell A Probate House In Texas In 2021 The Ultimate Guide

Valuation Discounts For Gift And Estate Tax Savings Wealth Management Captrust